Using Excel for economic modeling

The following videos will help you learn the basic functions that Microsoft Excel has to offer to aid you in economic modeling.

Text Problem 2-2

Calculate the present value, “P”, at time zero and the corresponding future value, “F” at the end of year three for a series of $15,000 payments to be made at the end of each of years one, two, and three. Assume that no payment is realized at time zero. Use a nominal interest rate of 15.0% compounded annually.

Text Problem 3-21

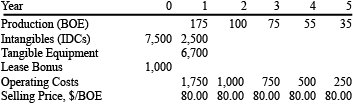

The following data relates to an oil and gas lease. (click on image for larger version)

Costs and production are in thousands.

Production is in barrels of oil equivalent (BOE).

Royalties are 12.5% of gross revenue.

Liquidation value at year 5 is $0.

- Calculate the annual before-tax cash flows for years 0-5.

- Determine the project ROR, NPV, and PVR for a minimum rate of return of 15%

- Determine the breakeven selling price in years 1-5 that would provide the investor with a 15% ROR.